Press Room

Experts In the News

“When students lead and run every aspect of the café, it brings excitement to campus dining choices, and to the overall campus vibe. The concept and fun menu is also going to be another game-changer regarding student engagement. Food is life. It’s one way we universally connect with each other.”

Professor Tarika Daftary Kapur

“Many of them look at this as the second chance they never thought they were going to get. And it’s not something that they want to give up.”

“No campus is perfect, and there’s probably room to improve across the country. If you look at the medical system, there’s more of a focus on physical wellness than psychological. It would be better if we thought about mental health and wellness in a holistic way.”

Search for Experts

Montclair State University’s faculty and staff offer a wealth of expertise and expert commentary for members of the press as they research, develop and produce their stories. Use the links below to locate the best nationally renowned expert for your story, or browse our full expert list.

Featured Topics

Follow Montclair State on:

University News

-

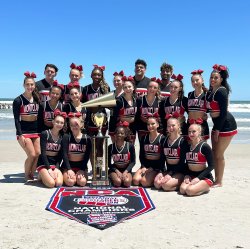

Montclair Cheer and Dance Teams Win National TitlesUniversity athletes rise to challenge to win back-to-back championships

Tuesday April 23, 2024 -

President Koppell Applauds University Partners at Spring Town HallThursday April 18, 2024

-

How Montclair Discovered the ‘Secret Sauce’ for Social MediaBurning Questions: No topic is too hot for President Jonathan Koppell in the ‘Red Hawt’ wings challenge

Monday April 15, 2024